Compounded annuity formula

Applying the future value of annuity with continuous compounding to this example would show. A Fixed Annuity May Provide A Very Secure Tax-Deferred Investment.

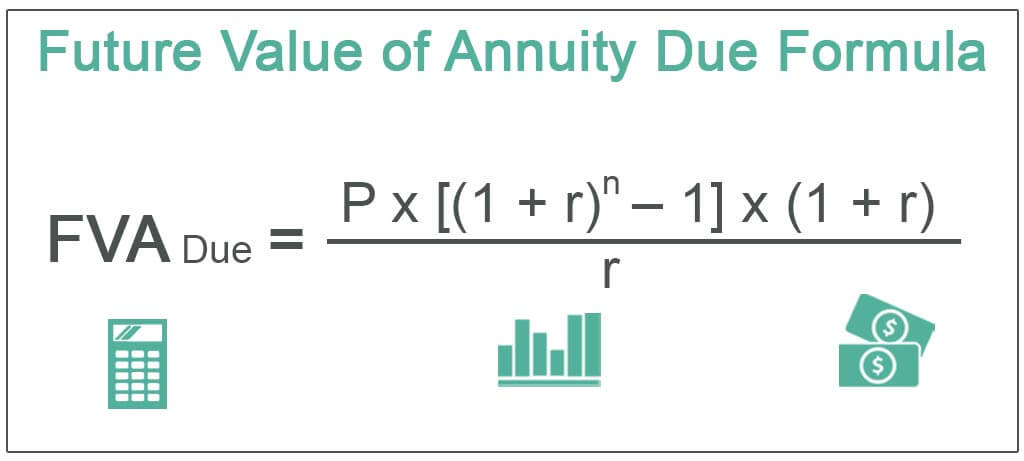

Future Value Of Annuity Due Formula Calculation With Examples

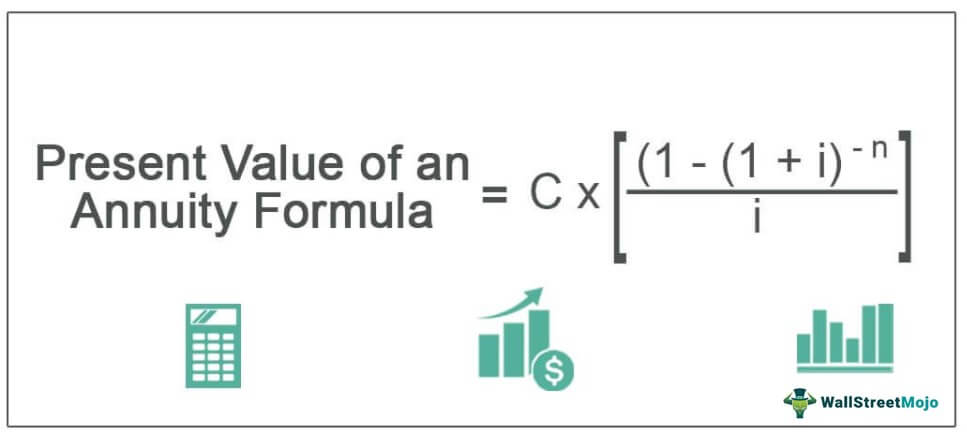

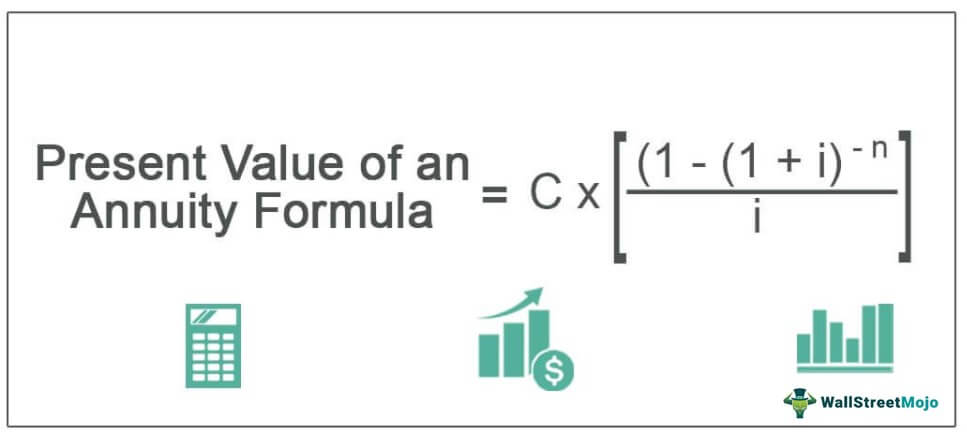

Formula to Calculate PV of Ordinary Annuity.

. Cq P 1r4n 1 You are free to use this image on your website templates etc Please provide us with an attribution link. Its algorithm is based on the standard compound interest rules and on annuity formulas. Compound Interest Formula FVPV1iN.

Where C q is the quarterly. The future value of an annuity due for Rs. Calculate the present value of an annuity due ordinary annuity growing annuities and.

Ad If you have a 500000 portfolio get this must-read annuity guide by Fisher Investments. FV 3 annuity due 5000 16 3 -16 x 16 1687308. Learn More On AARP.

5 which is the. In order to find the present value of this annuity assuming there is continuous compounding we can use the formula at the top of the page to show. Calculation using Formula.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Ad We Offer Different Types Of Annuities That May Fit Your Wants And Needs In Retirement. The compounded annual formula is used to calculate the interest that is earned on an investment over a period of time.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Firstly figure out the initial amount that is usually the opening balance of a deposit or loan. Brought to you by.

Annuity Formula FVPMT1i1iN - 1i. Annuities Can Allow You To Take Advantage Of Growth Without Risking Your Retirement Goals. The interest on a loan or deposit calculated based on both the initial amount and previous interest payments from previous periods is known as compound interest or compounding interest.

This would return a PV of 3286366. Ad A Calculator To Help You Decide How A Fixed Annuity Might Fit Into Your Retirement Plan. Where PV present value FV future value PMT payment per period i interest rate in percent per.

P Present value of your. 5000 at 6 for 3 years is higher. Annuity formula continuous compounding.

Ordinary Annuity Formula refers to the formula that is used to calculate the present value of the series of an equal amount of payments that are. Get this must-read guide if you are considering investing in annuities. The future value of a particular annuity with continuous compounding abbreviated at FVA is calculated using the following annuity.

The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. Which would return a result of 1233642. This formula considers the effects of compounding which is when.

Note that the rate used is 005 or. The formula for compounding can be derived by using the following simple steps.

Future Value Of Annuity Formula With Calculator

Pv Of Annuity W Continuous Compounding Formula With Calculator

How To Calculate The Present Value Of An Annuity Youtube

Annuity Formula Annuity Formula Annuity Economics Lessons

Annuity Payment Pv Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

Annuity Formula What Is Annuity Formula Examples

Annuity Due Formula Example With Excel Template

What Is An Annuity Table And How Do You Use One

How To Calculate The Future Value Of An Ordinary Annuity Youtube

Future Value Of An Annuity Formula Example And Excel Template

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Derive The Value Of An Annuity Formula Compounded Interest Youtube

Ordinary Annuity Calculator Future Value Nerd Counter

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

%201.gif)

Solve For Number Of Periods On Annuity Pv Formula With Calculator

Present Value Of Annuity Formula Calculate Pv Of An Annuity