30+ cash out mortgage refinancing

If you bought your home in 2012 when the average rate was 366 a cash out refinance will not magically gift you an even lower rate. Web Understanding cash-out mortgage rates.

Cash Out Refinance Requirements 2022 Bankrate

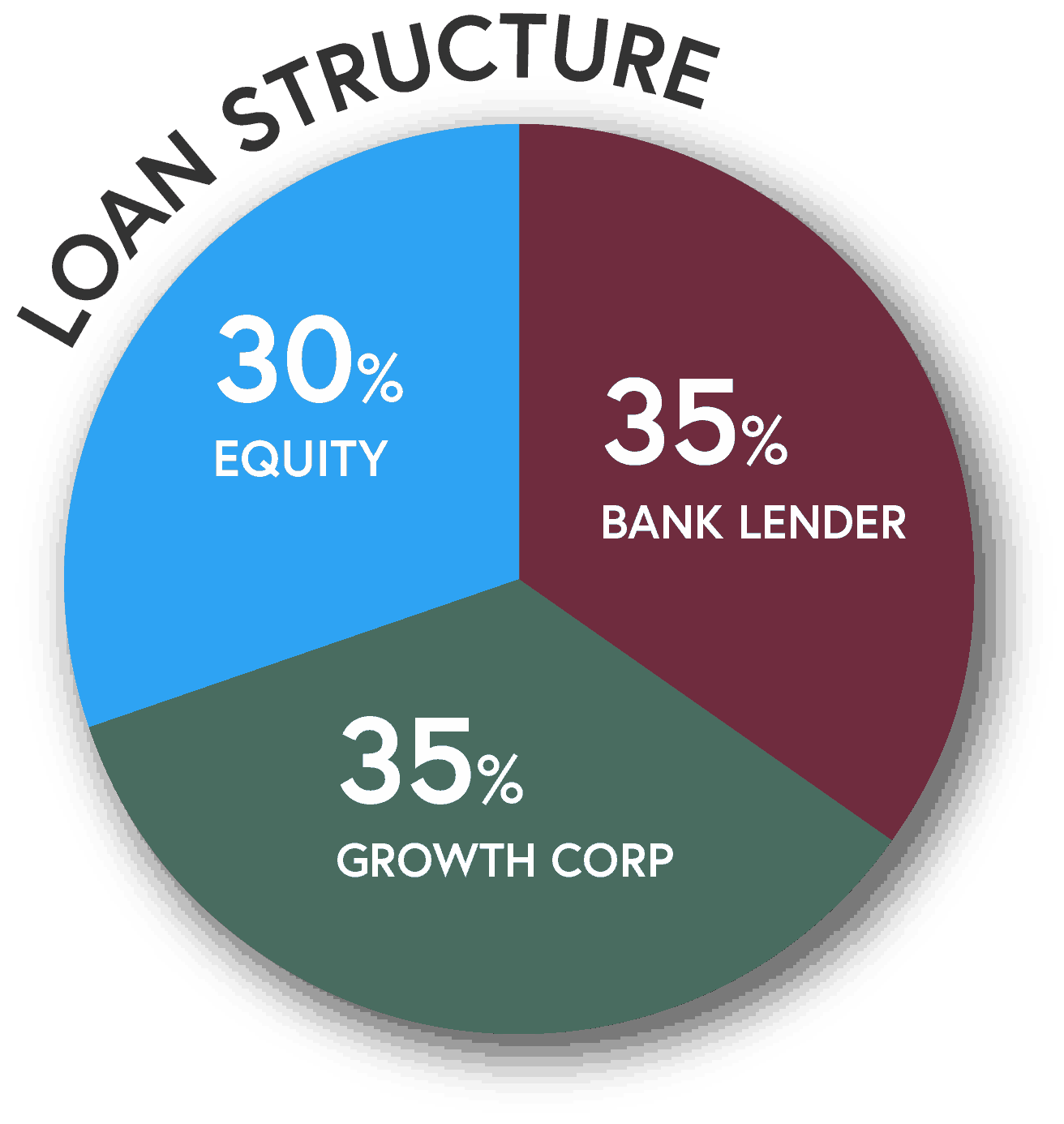

Therefore there is 500000 of the loan remaining and 500000 of equity value in the property from the borrower.

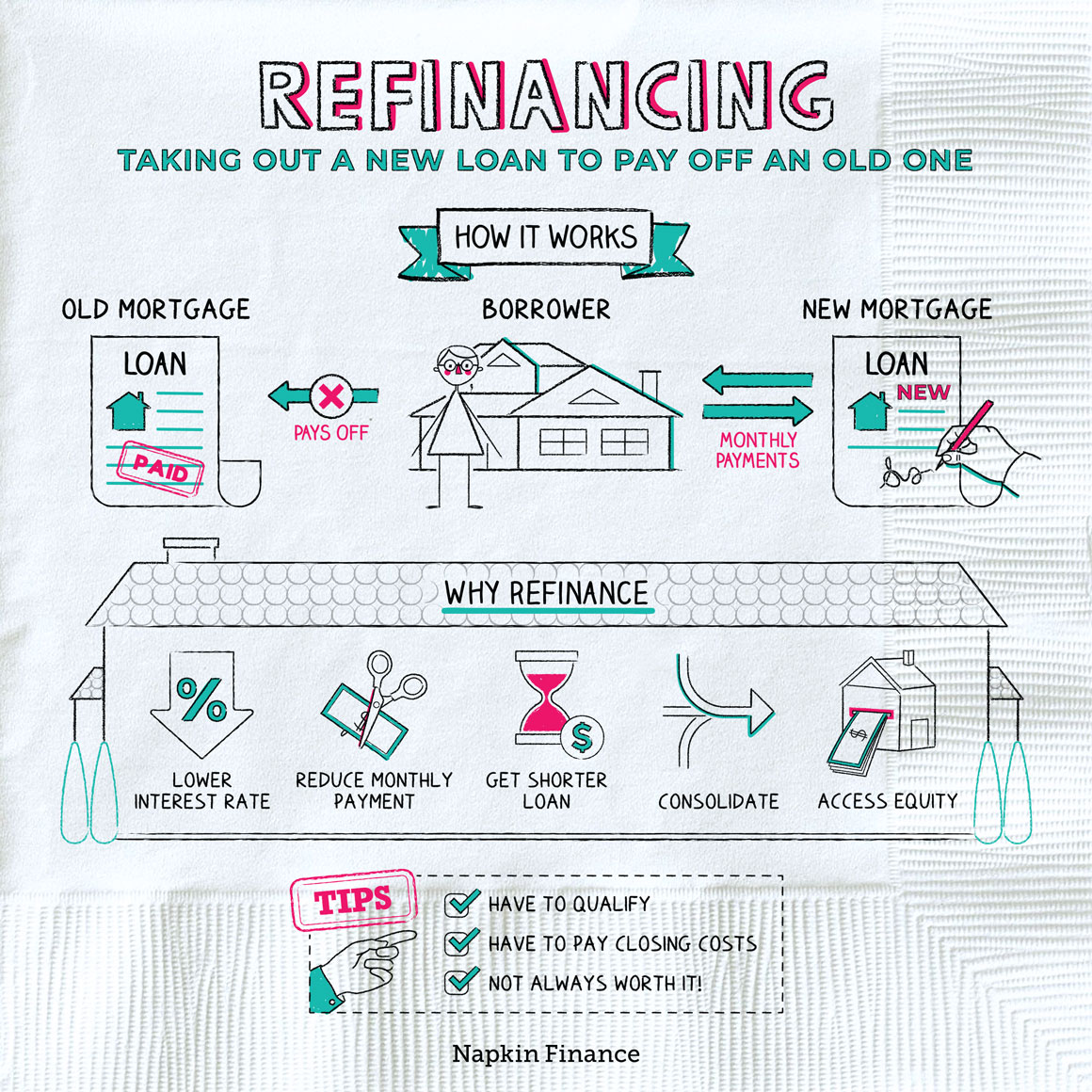

. Fortunately for borrowers rates are. In other words with a cash-out refinance you borrow more than you owe on your mortgage and pocket the difference. Web Example of a Cash-Out Refinance Say you took out a 200000 mortgage to buy a property worth 300000 and after many years you still owe 100000.

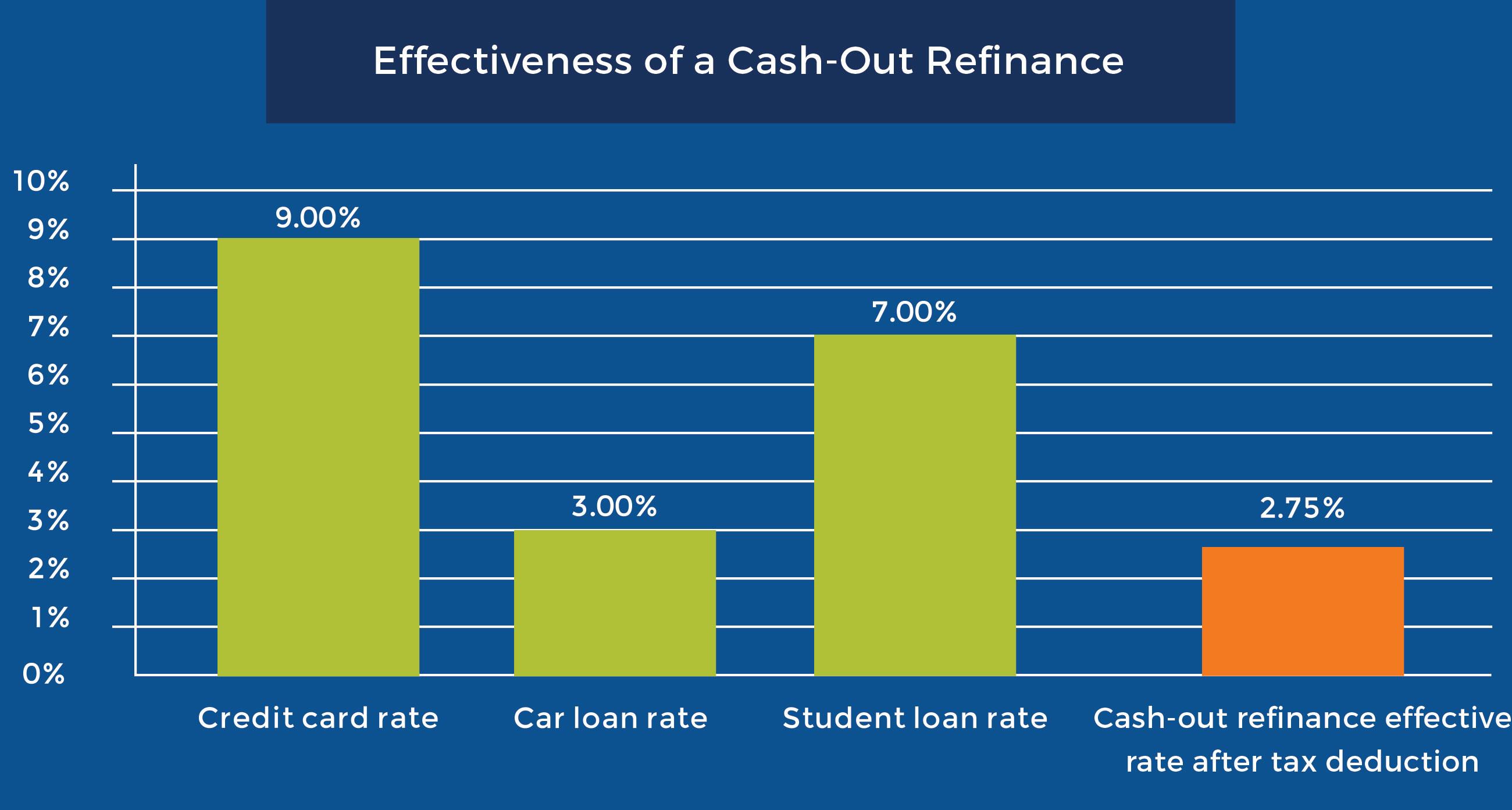

If you have a lump sum to apply to your existing mortgage amount try a cash-in refinance which reduces monthly payments further. Web Refinancing typically resets the length of your mortgage to 15 or 30 years. Web A cash out refinance would yield you a better rate if you bought your home in 2008 when the 30-year fixed was 603.

Instead you would lose money on the exchange. Web With a cash-out refinance you get a new home loan for more than you currently owe on your house. With cash-out refinancing you.

Navy Federal Credit Union Veterans United AmeriSave Freedom Mortgage PennyMac Better Home Point. Mortgage lenders typically allow you to borrow up to 80 of your homes. But when looking at long-term trends rates typically hover around 5 or 6.

The average 30-year fixed mortgage rate rose to 6. Web A 30-year refinance is when you convert your current mortgage into a new refinanced mortgage for a repayment period lasting 30 years. Web Cash-out refinancing replaces your current home mortgage with another bigger mortgage allowing you to access the difference between the two loans your current one and the new one in.

Therefore the borrower opts to initiate a cash-out refinance. Mortgage rates tend to rise or fall depending on whats happening with the economy. Assuming that the property value has not.

Web Opting for a 30-year cash-out refinance not only provides a chunk of cash for major expenses but it also frees up cash. Your current principal balance stretches across the additional payments reducing your monthly cost. Cash-out closing costs are typically higher than other refinance options because rates are higher and many borrowers opt to buy down their rate with mortgage points.

If you qualify you could obtain a home equity loan on a paid-off house or a home equity line of credit HELOC or reverse mortgage or you might opt for a cash-out refinance or shared. Youll be borrowing what you owe on your existing loan plus the cash you take out from your homes equity. Unlike a second mortgage or a home equity line of credit this is cash money in your hand payable when your new mortgage is approved and finalized.

Web A cash-out refinance is a type of mortgage refinance that takes advantage of the equity youve built over time and gives you cash in exchange for taking on a larger mortgage. Web Fortunately the answer is yes. COVID-19 Had an Outsized Impact on the United States.

The difference between that new mortgage amount and the balance on your previous mortgage. Web The average 30-year fixed refinance rate was around 626 in February which is nearly 30 basis points higher than it was in January according to Zillow data. A 30-year refinance term presents many benefits.

Web According to the data the 10 lenders with the best cash-out refinance rates on average are. Web With a cash-out refinance you would remortgage your home for 160000 and at closing you would receive a lump sum payout of 60000. Borrowers typically refinance their mortgage to.

Web Current 30-year refinance rate trends Average 30-year refinance rates are near a 20-year high at 645. Cash-out mortgage rates change frequently. Web For example there is a mortgage loan on a 1000000 property that is half paid off.

Web A cash-out refinance loan can be a good idea if youll get a lower interest rate and youll use the cash for college expenses or home repairs. Keep in mind that 30-year cash-out refinance rates are likely to be slightly higher than the rates offered on an original mortgage. Web A cash-out refinance is a new loan replacing your current mortgage.

Now the borrower wants to convert a portion of the 500000 equity into cash. Web With a cash-out refinance youll pay off your existing mortgage with a new larger loan and pocket the difference. Web Cash-out refinance closing costs range between 2-6 of the total loan amount and are deducted from your cash-out at closing.

Mortgage Refinance Guide Borrowing Basics Third Federal

Today S Cash Out Refinance Rates Forbes Advisor

Refinance Growth Corp

How To Refinance Your Mortgage

Cash Out Mortgage Refinance Calculator

House Party Like Its 2006 Cash Out Refinance Volume Has Grown Astronomically Bringing Back The Home Atm Dr Housing Bubble Blog

Compare Cash Out Refinance Rates Nerdwallet

How Do Cash Out Refinances Work Mintlife Blog

Cash Out Refinance Requirements

Refinance Home Loans Tips For 2023 Mortgage Choice

House Rich But Cash Poor Naomi Walker Senior Loan Officer

With Some Mortgage Refi Rates Below 3 How Much Could Get From A Cash Out Refi Marketwatch

Loan Refinance Refinancing A Mortgage When Can I Refinance My House Infographic

Cash Out Refinancing Is On The Rise Again Here S Why We Aren T Worried Urban Institute

Cash Out Refinance Calculator Current Cash Out Refi Rates

Steps To Refinancing Your Mortgage Global Integrity Finance

Hard Money Commercial Lenders Facebook